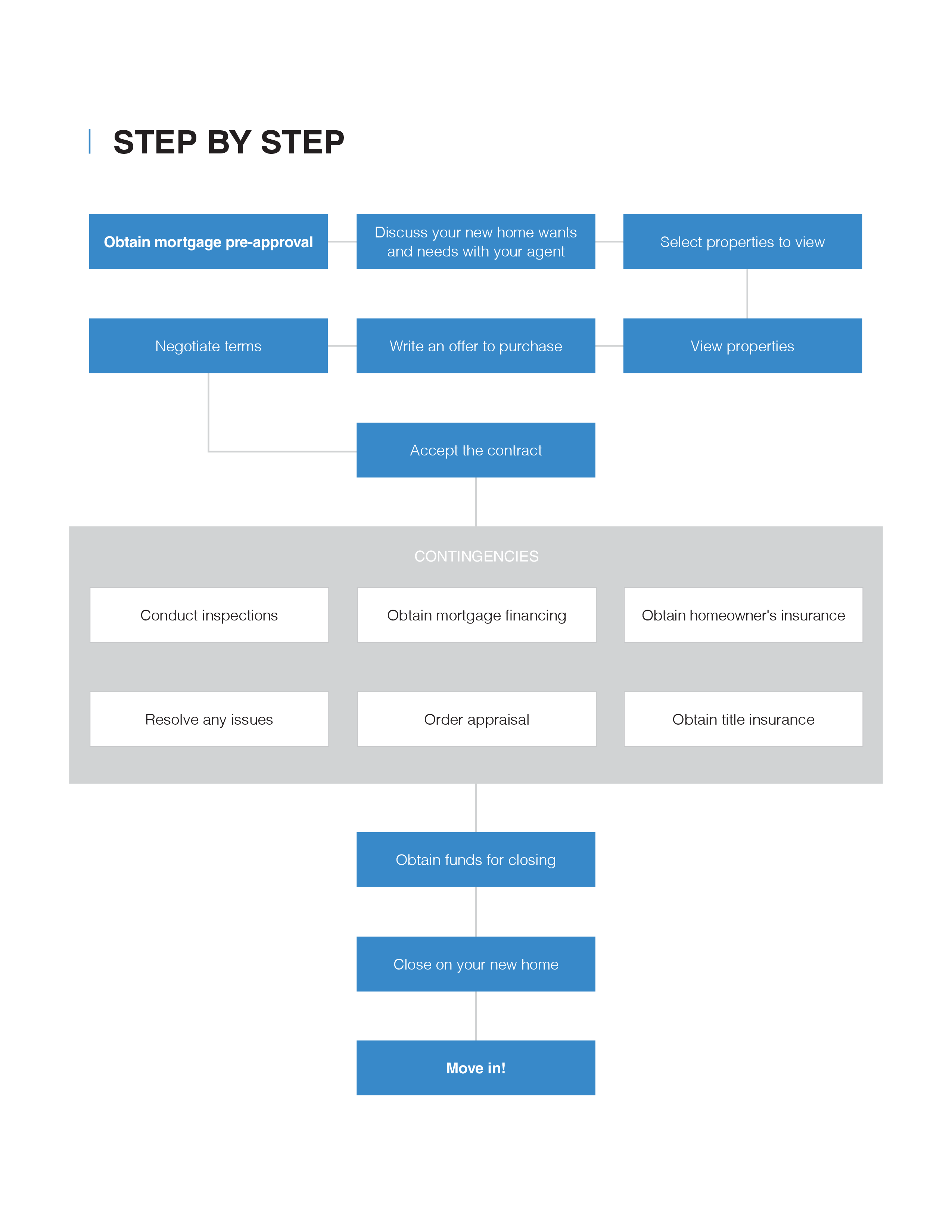

Buying a home is one of life’s biggest investments, but also one of the most exciting adventures. As your agent, I’ll be your partner along this process, guiding you to make your experience smooth and succcessful. Here’s a general overview diagram to get you started on the process.

1. Obtain Mortgage Pre-Approval

The first step in any home search is determining exactly how much you can afford and securing financing to make the purchase. Pre-Approval helps you:

- Understand your financial situation: Factor in down payment, closing costs, monthly mortgage, taxes, insurance, and maintenance.

- Know what you can afford before beginning any search: This is a vital step before you can reasonably search for any home.

- Strenghten your purchasing power when writing an offer: When you find the home you love and are ready to make an offer, your mortgage pre-approval lets the seller know that you’re serious and fully prepared to purchase their home, putting you in a strong position to write an offer and win the bid.

2. Begin House Hunting

The more I understand about the home you want the better I can tailor your home search. Take some time to think and write down the the features you need in a home as well as what you would ideally like to have in your new home.

- Define your priorities such as location, size, school district, and commute

- Discover information about the community and area.

- Review properties online to confirm area and features.

- Note and share with me any changes or updates to your home search preferences as you view properties.

3. Make A Offer

- Determine recent sold comparables to create the best offer and terms based on current market conditions.

- Be prepared for negotiations on price, closing date, and contingencies.

4. Closing On Your Home

- Work through any and all contingencies

- Schedule home inspections

- Pay earnest money

- Send seller’s attorney the results of the attorney contract review and inspection within 5 business days of the executed contract

- Provide lender with documents and information to satisfy any mortgage financing contengencies, and order an appraisal through your lender.

- Setup final walk through of home.

- Attend closing.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link